Coin shift hits different when you’re staring at your phone at 3 AM, seriously. I’m sitting here in my cramped apartment in Brooklyn right now, January chill seeping through the window, half-eaten pizza going cold on the desk because Bitcoin just tanked 5% while I blinked. That gut-punch feeling? Yeah, that’s the coin shift I’m talking about—the wild, nonstop cryptocurrency fluctuations that make crypto prices change so fast it’s like riding a rollercoaster built by a maniac.

I got into this mess back in 2021, all hyped on the bull run, threw in some savings thinking I’d be chilling on a beach by now. Nope. Last year alone, I watched my portfolio do more flips than a bad gymnast. One night I’m up 20%, texting friends like “we’re rich, bro!” Next morning? Down 15%, and I’m googling “how to sell everything without crying.” Embarrassing? Totally. But that’s crypto volatility for you—raw, unfiltered, and it exposes how flawed we all are chasing these coin shifts.

Why Coin Shift Happens So Damn Fast in Crypto

Look, cryptocurrency fluctuations aren’t random, but they feel like it when you’re in the thick of it. The market’s still young—way smaller than stocks—so even a little money moving in or out causes massive crypto price volatility. Like, Bitcoin’s market cap is huge now, hovering around $1.8 trillion as I’m writing this on January 7, 2026, with BTC chilling near $92,000 after dipping and spiking all week. But compared to traditional markets? It’s tiny, so coin shifts hit harder.

Supply and demand basics, but cranked to 11. Bitcoin’s capped at 21 million coins, so when demand spikes—say from big institutions piling in—prices moon. Reverse? Crash. I learned this the hard way last month when some whale dumped a ton, and poof, my altcoins bled out.

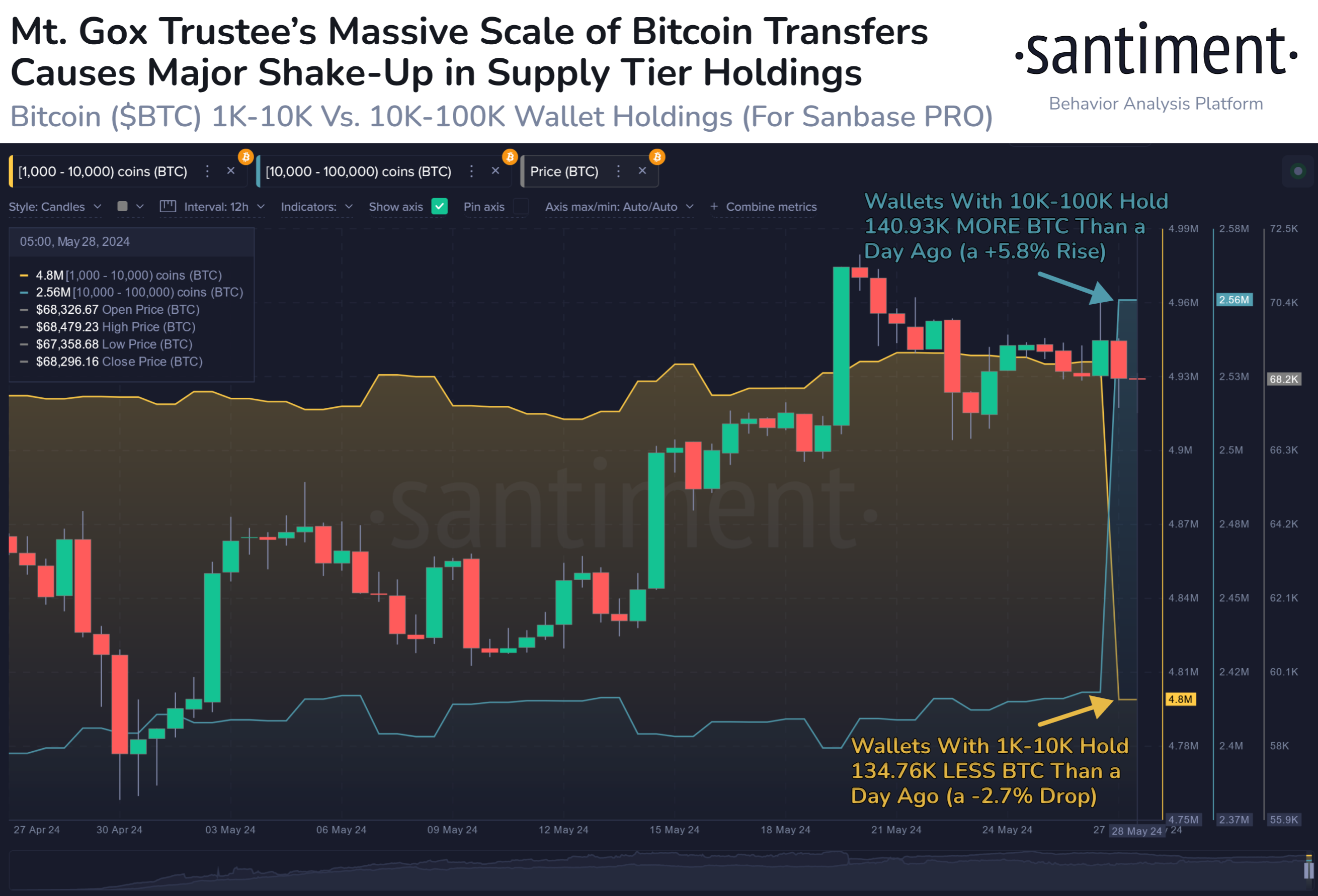

Mt. Gox’s First Transfers in Over 6 Years Has Instantly Changed …

Whale Moves and Why They Wreck Coin Shift Chaos

Whales—those big holders with millions—are the kings of crypto price volatility. One dude (or fund) sells a chunk, and bam, prices tank because the market can’t absorb it fast without panicking. According to stuff I’ve read on Investopedia, whales can swing Bitcoin wildly, and yeah, I’ve felt it.

Remember that time—I think it was late 2025—when rumors of a big transfer hit? I was refreshing charts, heart pounding, and watched everything drop 10% in hours. Turned out to be some old wallet moving coins, but the fear spread like wildfire. I sold too early, of course. Classic me, panicking while the smart money buys the dip.

Check out this explanation on how whales drive volatility: https://www.investopedia.com/terms/b/bitcoin-whale.asp

Market Sentiment and News Triggering Fast Crypto Changes

Sentiment is everything in these cryptocurrency fluctuations. One tweet, one regulatory hint, and coin shift goes berserk. Elon Musk memes still haunt me—back when his posts would pump or dump Doge, I’d chase it like an idiot, lose money, swear off it, then do it again.

These days, it’s macro stuff: Fed rate cuts, geopolitical drama. Early 2026 has been choppy—BTC jumped to $94k then back down—partly from ETF flows and global uncertainty. BlackRock even noted liquidity and rate expectations driving swings this year: https://www.blackrock.com/us/financial-professionals/insights/exploring-crypto-volatility

Elon Musk Posts Meme Mocking Crypto Fans, Then Crypto Crashes

And don’t get me started on FOMO. I FOMO’d into some altcoin last year because everyone on X was yelling “to the moon!” Woke up to it rug-pulled. Lost a chunk, felt stupid for days, ate way too much junk food stressing. But hey, lesson learned? Kinda. I still check charts too much.

My Flawed Tips for Surviving Crypto Price Volatility

- Don’t bet what you can’t lose. I did once, had to skip rent scares. Dumb.

- Zoom out—crypto’s volatile short-term but trends up long-term if you believe in it. Sources like Caleb & Brown say immaturity drives swings, but adoption helps: https://calebandbrown.com/blog/crypto-volatility/

- Set alerts, but don’t obsess. I do anyway.

- Diversify a bit, but honestly, I’m mostly BTC now after altcoin burns.

Anyway, coin shift is brutal but addictive. It’s taught me patience (sorta) and that I’m way more emotional about money than I thought. Contradictory? Yeah—I hate the drops but love the thrill.

Wrapping this ramble: Crypto prices change so fast because it’s a wild mix of sentiment, whales, news, and thin liquidity in a young market. My take? Embrace the chaos or stay out—it’s not for the faint-hearted.