Passive income crypto is honestly the only thing keeping me afloat right now, here in my tiny apartment somewhere in the Midwest US, rain pounding the window on this dreary January 8th evening in 2026, coffee mug empty again.

Like, I swear, I never saw myself as the type to geek out over block wealth or whatever, but yeah, those little reward notifications? They hit different when Bitcoin’s chilling around $91k and everything else feels expensive as hell. It’s not perfect—I’ve had months where yields tanked and I freaked out, thinking I’d blown my savings on nothing—but man, when the passive streams flow, it’s like free money (kinda, sorta). Anyway, here’s my unfiltered take.

How I Accidentally Fell Into Passive Income Crypto (And Stayed)

It started back in like 2022 or whenever, me bored out of my mind during some dead-end job, dumping a couple hundred bucks into ETH because everyone on Twitter—sorry, X—was yelling about it. Watched it moon, then crater, classic rookie move. But then I discovered staking, and suddenly passive income crypto didn’t sound so scammy.

Now in 2026, with ETH around $3100 or whatever it’s at today, I’ve mostly ditched the wild trading for steadier stuff. Block wealth for me just means letting my crypto work instead of me stressing over charts 24/7. Sure, I still check too often, and yeah, I panicked during that late 2025 dip, almost unstaked everything. Dumb.

My Go-To Ways for Earning Crypto Passive Income in 2026

No BS list here—these are what I’m actually doing for my passive income crypto setup. Tried others, got burned (remember that one DeFi thing that rugged? Yeah, not naming names, still stings).

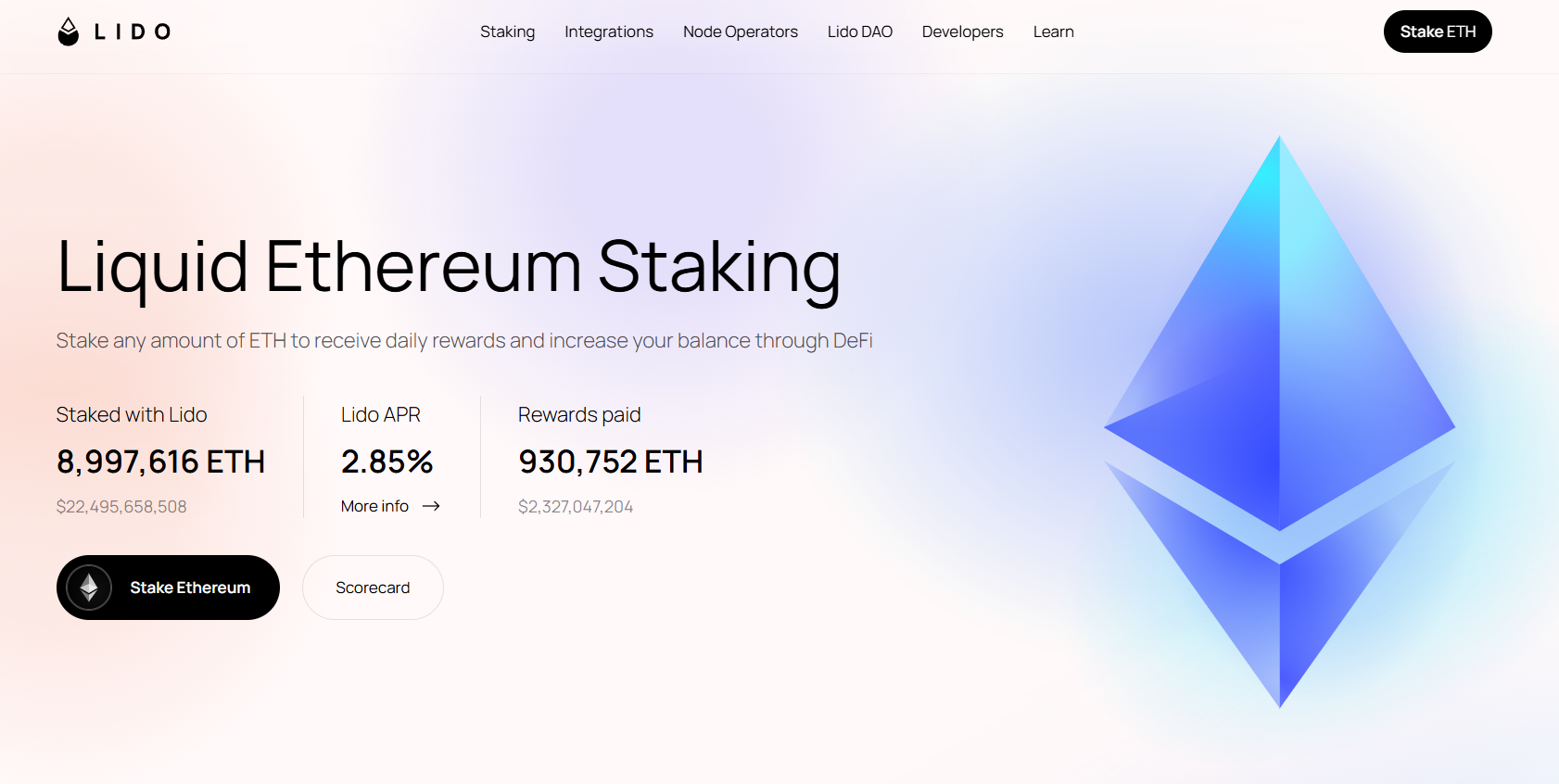

- Staking ETH: Still my favorite. Lock it up, help the network, get rewards. I’m on Lido for liquid staking—around 2.9% APY lately per stakingrewards.com, not insane but steady. No running a node, just chill.

- Lending Stablecoins: Park USDC or whatever on Aave, earn interest. Safer than volatile stuff, but watch liquidations—I learned that the hard way in a flash crash.

- Some Yield Farming: Riskier, but I dip into pools for extra boosts. Only with play money now, after losing a chunk chasing high APYs.

ETH staking rewards hovering low-ish at like 2.9% (check beaconcha.in for real-time), but compounding adds up.

The Screw-Ups That Shaped My Block Wealth Passive Income Crypto Journey

Honesty hour: Chased some 500% yield farm in 2024, got absolutely rekt when it imploded. Lost enough for a nice trip. Also, totally ignored taxes at first—now scrambling with the IRS because yeah, crypto passive income is taxable AF in the US. Use something like CoinTracker if you’re messy like me.

And the dips? During that 2025 mess when BTC dropped hard, my rewards slowed, anxiety spiked. Almost sold low, again. But sticking through it? Rewards are back, portfolio’s recovering.

Okay, Wrapping Up This Passive Income Crypto Mess

Building any real block wealth with crypto passive income takes time, mistakes, and a ton of patience—setup ain’t truly passive at first. Research sucks sometimes, volatility hits hard. But for me, those extra couple hundred bucks a month from staking and lending? They’re covering bills, letting me sleep better in this crazy economy.

Start small if you’re new, always DYOR (hit up coingecko.com for data), and never throw in what you can’t lose. What’s working for you on the passive income crypto front these days? Drop your stories below—wins, fails, all of it. Let’s talk.