Smart crypto investing for beginners ain’t this perfect, polished thing—it’s me right now, January 8th, 2026, in my kinda cluttered apartment here in the US, laptop open with charts everywhere, cold coffee sitting next to me getting colder, wondering if Bitcoin’s gonna push past that 92k mark today or dip again.

Like, I remember getting into blockchain wealth strategies back in ’23, all hyped up thinking I’d moon quick. Nah. I FOMO’d hard into some sketchy altcoin ’cause X was blowing up about it, and boom—lost half overnight. Felt like crap, seriously. Was glued to the screen, heart racing, barely ate. But that’s my messy American take—regular guy trying not to mess up too bad while stacking sats.

Anyway, here we are early 2026, market’s volatile as ever. Bitcoin’s bouncing around 91-93k after that early January pump (check current vibes on Forbes’ crypto list: https://www.forbes.com/advisor/investing/cryptocurrency/top-10-cryptocurrencies/). Ethereum’s hovering over 3k, feeling that institutional push from ETFs. But I’m done chasing hype. Learned the hard way smart crypto investing for beginners means long-term plays, not gambling.

Frustrated day trader feeling upset, looking at PC display …

My Biggest Screw-Ups in Smart Crypto Investing for Beginners (Yeah, I’m Owning Them)

Man, I’ve botched plenty. Not DYOR-ing enough—threw cash at “hot” tokens without digging into the project, got rekt on a rug-ish pull (pro tip: always check teams and whitepapers, like Investopedia warns: https://www.investopedia.com/costly-cryptocurrency-investing-mistakes-11717644).

FOMO buying high, panic selling low. Crypto dips 20% easy on bad news—sold during a correction last year, hate myself for it now. Overtrading too, fees killed me.

Security? Kept everything on exchanges first. “Not your keys, not your crypto”—almost phished once, freaked out bad. Switched everything up after that.

Tangem Wallet Pack of 3 Secure Crypto Wallet Trusted Cold Storage …

Real Blockchain Wealth Strategies That Work for a Flawed Dude Like Me

Raw truth—my smart crypto investing setup is basic ’cause I’m no pro trader. Sticking mostly to Bitcoin and Ethereum, the OGs (Forbes still ranks ’em top for a reason: https://www.forbes.com/advisor/investing/cryptocurrency/top-10-cryptocurrencies/).

Dollar Cost Averaging Saved My Butt in Crypto Investing for Beginners

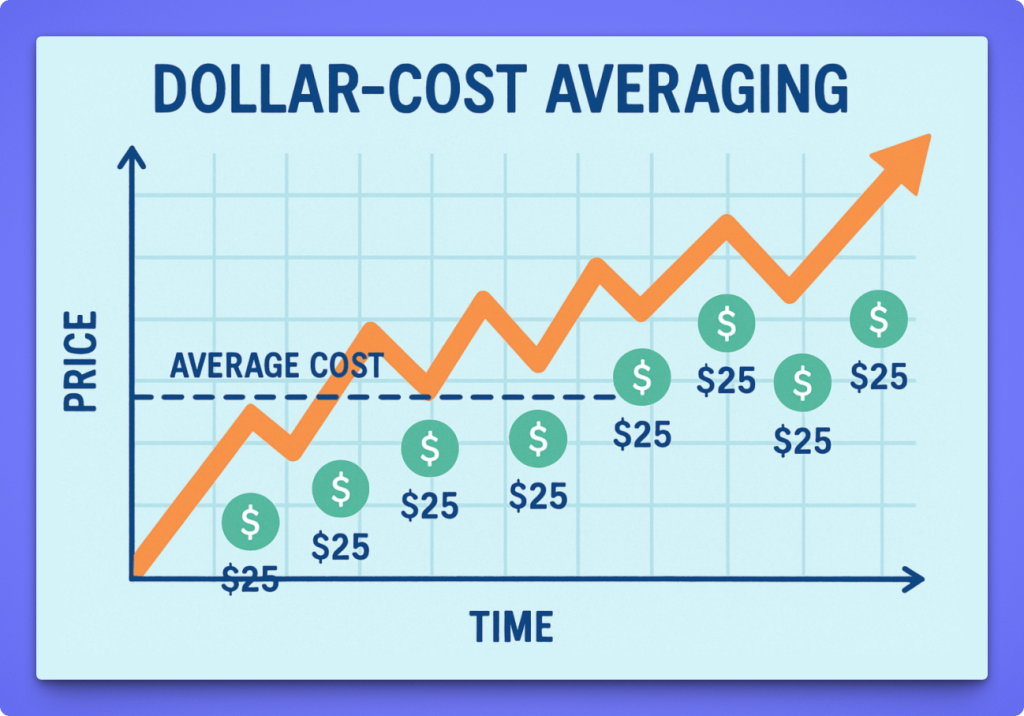

DCA is my lifeline. No lump sums and timing stress—just auto-buy fixed amounts, like every paycheck into BTC/ETH. Dips mean more coins, pumps mean less. Smooths the crazy volatility.

Removes the emotion, perfect for beginners. No guessing “is now the bottom?” Experts love it for markets like this (Fidelity breaks it down good: https://www.fidelity.com/learning-center/trading-investing/crypto/dollar-cost-averaging).

How Much Should I Invest in Bitcoin: Guide for Profit (2025)

Quick list how I do it:

- Set fixed buys weekly or monthly

- Tune out daily noise

- HODL long-term (hold on for dear life, ya know)

Been DCA-ing over a year, even through ’25 dips—my average entry’s solid now.

Beginner Crypto Tips: Lock It Down with Wallets

Exchanges for trading only—move to hardware for holding. Went with Ledger after my scare (top hardware picks still include Ledger/Trezor in 2026: https://www.nerdwallet.com/p/best/investing/crypto-bitcoin-wallets).

Offline, hackers hate that. Backed up seed offline, no pics. 2FA everywhere, duh.

Wrapping Up This Messy Chat on Smart Crypto Investing for Beginners

Look, blockchain wealth strategies aren’t overnight riches—they’re grinding through volatility. I’m still here, still checking charts with my lukewarm coffee, still learning from screw-ups. But DCA, real research, tight security, and only risking what I can lose? That’s keeping me going.

If you’re jumping in, start small—maybe DCA on Coinbase or something easy. Dive into basics (Coinbase has decent guides: https://www.coinbase.com/learn/crypto-basics/what-is-dollar-cost-averaging-dca). Not advice, just my chaotic journey.