The decentralized finance grid is this insane tangle of protocols that’s been eating my brain for years now, like I’m here in my Austin apartment—January 8, 2026, it’s kinda chilly for Texas, my heater’s rattling, leftover Whataburger wrapper on the desk—and I’m still trying to wrap my head around how DeFi really works without some bank overlord. I jumped in hard during the 2021 hype, tossed a bunch of ETH into some random pool thinking I’d be sipping margaritas on yields forever, and boom, impermanent loss hit me like a truck. Lost like 40% in a week. Felt so stupid, seriously, but that’s the decentralized finance grid for ya—empowering but it’ll humble you quick.

Anyway, rambling as usual, but let’s break it down like I’m explaining to a buddy over beers.

Why I’m Still Hooked on the Decentralized Finance Grid (Even After the Burns)

The thing that keeps pulling me back to the decentralized finance grid is the no-BS freedom. No KYC nonsense, just me lending USDC on Aave and earning decent APY without some teller judging my transactions. But gas fees? Man, I remember in the peak bull, paying $150 to approve a contract, sitting here cursing at my screen while the AC blasted because Texas summer plus rage is lethal. Now with L2s like Arbitrum, it’s way better in 2026, but still, the decentralized finance grid ain’t perfect—it’s volatile as hell.

Basic block diagram using blockchain and ML techniques. | Download …

Smart Contracts: The Glue Holding the Decentralized Finance Grid Together

Smart contracts are basically the rules of the game—code that runs itself on Ethereum or whatever chain. No middleman, just if-this-then-that. I got rekt once clicking “approve” on a fake site; wallet drained faster than I could refresh. Total rookie move. Always double-check addresses on Etherscan. Good read on basics here: Ethereum smart contracts docs.

Career • DeGatchi

Liquidity Pools and AMMs in the Decentralized Finance Grid: Where the Magic (and Pain) Happens

This is the core, y’all—automated market makers like Uniswap let anyone provide liquidity. You pair tokens, pool ’em, earn fees from trades. The formula’s that constant product thing, x*y=k, keeps prices balanced. But impermanent loss? I provided to a ETH/some-shitcoin pair, price mooned one way, and I ended up with less value than just holding. Ouch. Check Uniswap docs for the real deal.

- Drop equal values into the pool

- Traders swap, you get a cut (like 0.05% to 1%)

- Yields can be juicy with farming on top

- But volatility = potential big L’s (learned that the hard way)

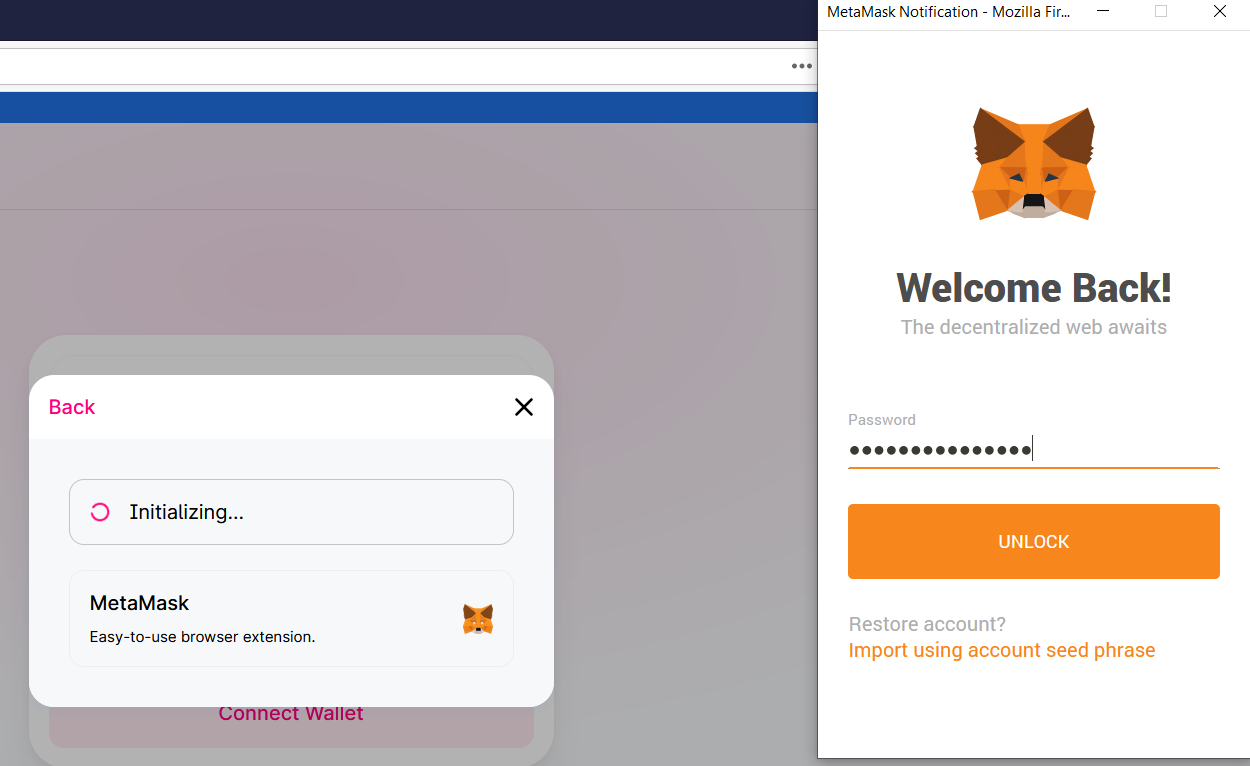

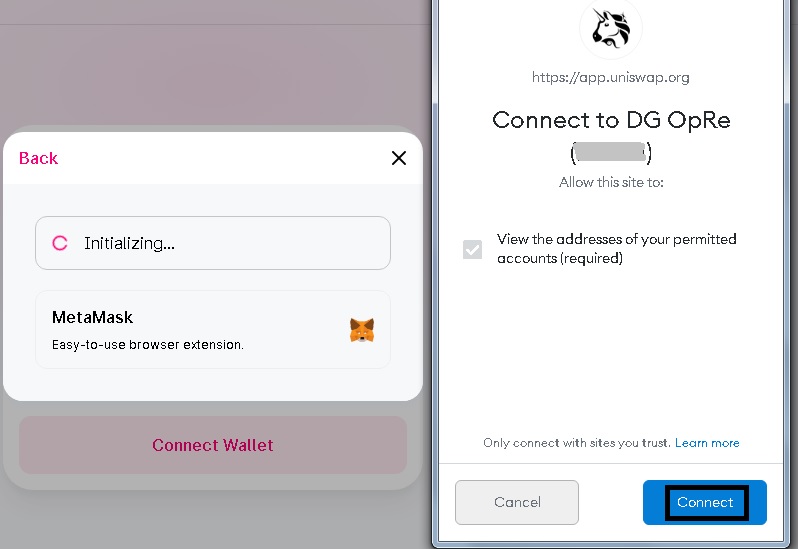

Jumping Into the Decentralized Finance Grid Without Totally Screwing Yourself

Start with MetaMask—download it here, connect wallet, boom. I still click “connect” with my heart racing every time, remembering that one phishing scare.

Rug pulls still happen, even now. Aped into a “high-yield” thing last year, dev vanished, wallet lighter. Sat there facepalming for an hour.

The decentralized finance grid’s flawed, thrilling, contradictory—hate the risks but love not needing permission for my money. I’m still farming modestly on Base now, yields meh but safer.

Start tiny, use a Ledger if you can, track everything on DeFiLlama. Drop your DeFi stories below—I wanna hear ’em, good or bad. Let’s keep learning together, yeah? Stay smart out there.