Cryptocurrency market trends are absolutely wild right now, like, seriously, I’m sitting here in my cramped apartment in Brooklyn—coffee gone cold, window cracked because it’s unseasonably warm for January in the US—and cryptocurrency market trends have me refreshing charts every five minutes.

It’s January 7, 2026, and Bitcoin’s hovering around that $92,000 to $93,000 mark after teasing $94k yesterday and then, poof, profit-taking kicked in and dragged it back down a bit. Total market cap dipped to like $3.27 trillion or something—feels like everyone’s exhaling after that early-year pump. I got burned bad last month thinking we’d moon straight to $100k off the bat; sold some alts too early, classic me, always second-guessing. Anyway, here’s my messy breakdown of what’s actually driving the crypto pulse today.

Why Cryptocurrency Market Trends Are Dipping Today But Still Feel Bullish

Look, cryptocurrency market trends aren’t crashing or anything—it’s more like a breather. BTC’s down about 1-2% today, failing to hold those intraday highs, and alts like ADA and XLM are feeling it worse. But analysts are saying we’ve bottomed, institutional demand is the real driver now, not just the old four-year cycle hype. Bernstein folks are out here calling it: market’s bottomed, get ready for more upside. Me? I’m cautiously optimistic, but yeah, I panicked and moved some to stablecoins last night when it dipped—embarrassing, but honest.

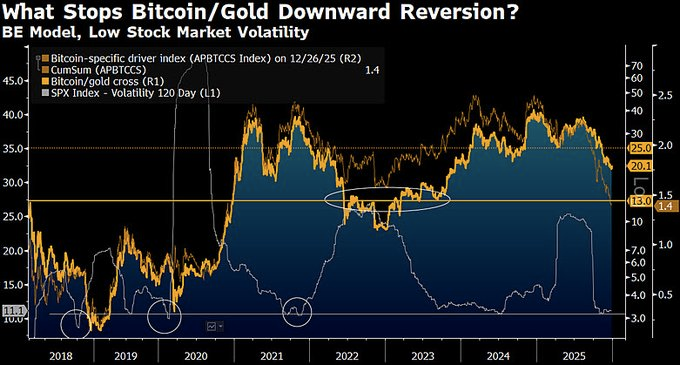

Check out these charts—Bitcoin’s been on a tear since New Year’s, up like 7% YTD, but today’s pullback? Classic volatility.

Institutional Money: The Big Driver Behind Crypto Market Trends Right Now

This is the game-changer for cryptocurrency market trends in 2026—institutions are all in. Spot ETFs are seeing massive inflows again, Morgan Stanley filing for BTC and Solana ETFs, BlackRock and crew predicting hundreds of billions in AUM. It’s not retail FOMO anymore; it’s suits allocating fresh capital. Tom Lee’s doubling down on a new ATH this month, maybe even $250k if things break right. I learned this the hard way: back in ’25, I ignored institutions and chased memes, lost a chunk. Now? I’m stacking more BTC on dips, feels safer somehow.

For real though, check this Reuters piece on Morgan Stanley’s push or Bernstein’s bullish call.

Altcoins and Volatility: What’s Moving in Cryptocurrency Market Trends

XRP’s been killing it lately, flipping BNB at one point, up double digits early in the year—Ripple drama finally paying off? Solana and ETH holding strong too. But today? Some profit-taking across the board. Token unlocks worth hundreds of millions hitting this week aren’t helping the short-term vibes. Crypto volatility is no joke; one minute you’re up, next you’re staring at red candles wondering if you should sell the car.

This volatility chart sums up my mood—swings everywhere, but the trend’s up if you zoom out.

My Personal Screw-Ups and Tips on Navigating Crypto Market Trends

Real talk: I FOMO’d into some random alt last week because Twitter said it was “the next big thing,” down 20% now. Lesson? Stick to the big drivers—institutional flows, ETF data (check CoinDesk for live stuff: https://www.coindesk.com/markets/2026/01/06/crypto-prices-retreat-in-return-to-downward-u-s-trading-day-action), and don’t chase every pump. Set alerts, dollar-cost average on BTC, and maybe keep some dry powder for these dips. I’m doing that now, feels less stressful.

Yeah, that’s basically me right now—stressed but holding.

Anyway, wrapping this ramble: cryptocurrency market trends feel solid long-term despite today’s wobble—institutions, fresh allocations, and that post-holiday momentum. Short-term? Who knows, crypto’s chaotic. But I’m not selling my core stack.