Decentralized finance grid has been straight-up wrecking my sleep schedule lately, y’all—lending out my crypto, staking for those passive rewards, chasing yield like it’s gonna make me rich overnight. I’m holed up in my apartment in Austin right now (yeah, moved here last year for the vibes, but mostly the cheaper rent), fan whirring ’cause it’s unseasonably warm for January, half-drunk energy drink on the desk next to my second monitor that’s just blasting red candles. Anyway, this decentralized finance grid breakdown is me trying to make sense of it all, with my dumb mistakes included free of charge.

Seriously, I got into DeFi lending thinking I was gonna outsmart the system—threw some USDC into Aave back in ’24 (still my go-to, check it: https://aave.com/), watched the APY hover around 4-5% lately, felt pretty good. Then the market dips a bit, borrow demand spikes, and my yield barely covers the anxiety. Embarrassing story: I once looped my collateral to farm extra yield, thought I was a wizard, but forgot to monitor health factor during a flash crash—got liquidated on like 20% of it. Woke up to notifications at 3am, heart pounding, coffee spilled everywhere. That’s the decentralized finance grid for you—no mercy, just code doing its thing.

My Real Talk on DeFi Lending in the Decentralized Finance Grid

DeFi lending is kinda the foundation of this whole decentralized finance grid mess. You supply tokens to pools, borrowers pay interest, smart contracts handle the rest—no bank telling you no.

I’m mostly on Aave these days, TVL still crushing at over $34 billion according to DefiLlama. Supplied some stablecoins last week, pulling maybe 4% variable right now—nothing crazy compared to bull market highs, but steady. Morpho’s up there too if you want optimized rates.

What Is DeFi Saver: The All-in-One DeFi Management Dashboard …

But the contradictions hit hard—I love the permissionless vibe, hate the liquidation risk. Borrowed against my ETH once to ape into a “sure thing” alt, yield looked juicy at like 8%, then everything dumped. Poof, collateral gone. Learned: overcollateralize way more, and don’t borrow to gamble if you’re as impulsive as me. Trends in 2026? More RWA stuff bleeding in, fixed rates for the risk-averse.

Staking Yield Thoughts in This Decentralized Finance Grid Rollercoaster

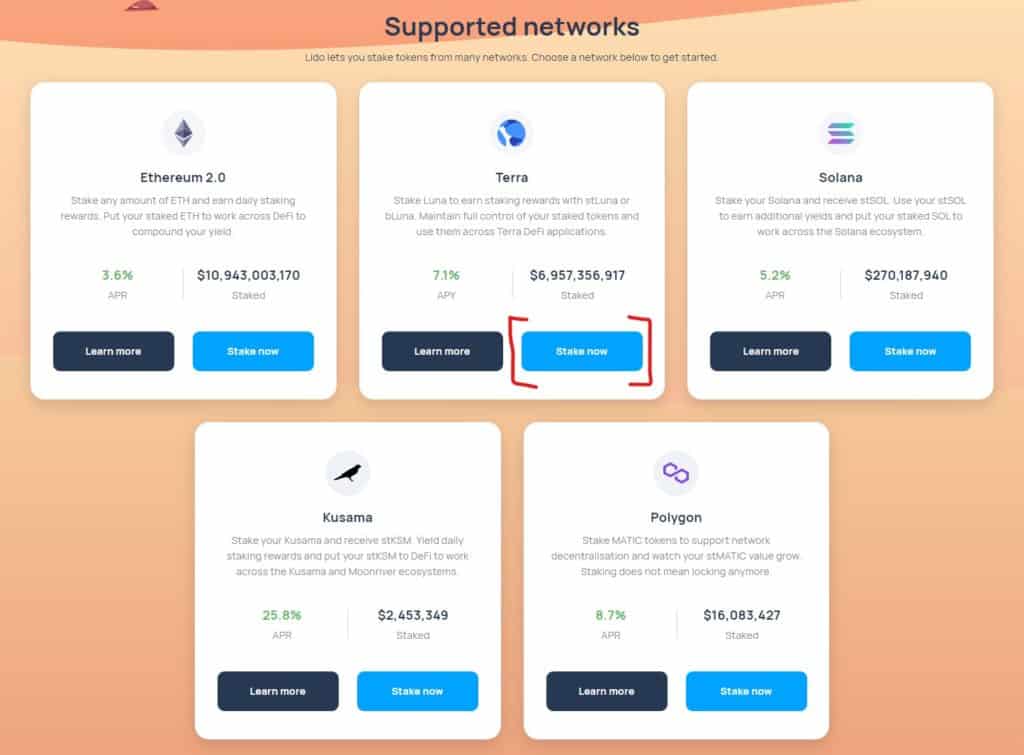

Staking yield feels safer, kinda—lock in ETH via Lido, get stETH that’s actually usable elsewhere.

Current rewards sitting around 2.5-2.6% from what I’m seeing—down from the post-merge hype days, but it compounds, and that little daily bump in balance still hits nice. Sensory thing: Checking my wallet app in the morning light filtering through blinds, seeing the number tick up a tiny bit, small win.

Guide to Staking With Lido – DeFiGuide.org

Self-deprecating moment: I staked heavy early, yields were 4%+, thought I cracked passive income. Now in 2026, more supply, yields chilled out. Tried some Solana staking for higher numbers, got slashed on a dodgy validator—lost a chunk, felt so stupid. Lido’s still solid for liquid staking, Rocket Pool if you want decentralized.

Yield Farming Chaos in the Decentralized Finance Grid

Yield farming’s the wild part—LP on Uniswap or Curve, farm tokens, compound like mad.

Did a stable pair on Curve last year, steady 5-8%, but chased a high-APY pool once—50% temporary from emissions. Impermanent loss ate me alive when prices shifted, ended with garbage tokens. Classic rookie move.

Now I’m boring: stable LPs for lower but real yield, or restaking plays. 2026 vibes? Cross-chain stuff, but IL still hurts bad. Tip from my screw-ups: Use DefiLlama yields page to scout, start tiny, ignore triple-digit APYs—they scream rug.

Look, this decentralized finance grid—lending, staking yield, farming—it’s addictive, flawed, sometimes straight-up punishing. I’m still deep in, regretting some nights, hyped others. Diversify, hardware wallet everything, never risk what you can’t lose.