Proof of stake vs proof of work has been eating at me lately, seriously. I’m sitting here in my cramped apartment in suburban Texas—it’s January 2026, the heater’s cranking because it’s weirdly chilly for once, and I’ve got this half-empty mug of crappy instant coffee going cold on my desk while I stare at my laptop screen running a little Ethereum staking node. Proof of stake vs proof of work isn’t just some abstract debate for me anymore; it’s real money, real electricity bills, and yeah, some real regrets from back when I dabbled in mining.

Like, back in 2021, I was that idiot who bought a couple used ASICs during the bull run hype. Thought I’d mine Bitcoin and get rich quick. My electric bill shot up to like $400 a month—dude, in summer here that’s brutal—and the noise? My girlfriend at the time threatened to leave because the fans sounded like a jet engine in our living room. Total embarrassment. Sold ’em at a loss when the market dipped. Proof of work felt hardcore, decentralized, like real digital gold mining, but man, it wrecked my wallet and my relationship.

Why Proof of Stake Vs Proof of Work Even Matters to a Schmuck Like Me

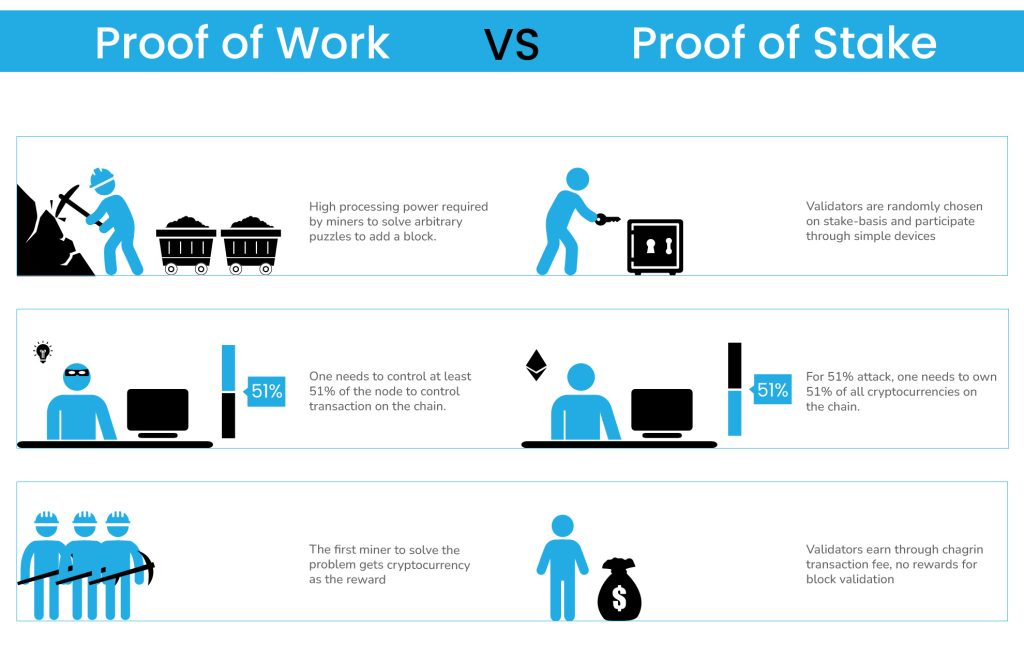

Proof of stake vs proof of work boils down to how blockchains agree on what’s real. Proof of work? Miners race to solve puzzles, burning insane energy. Bitcoin’s still chugging on that, consuming like 150 TWh a year—more than some countries (check out the Cambridge Bitcoin Electricity Consumption Index for the latest numbers: https://ccaf.io/cbnsi/cbeci). Proof of stake? You lock up coins as “stake,” get randomly picked to validate, way less power. Ethereum switched in 2022, dropped their energy use by over 99%—now it’s like 0.0026 TWh/year, basically nothing compared to Bitcoin (per CCRI reports: https://carbon-ratings.com/eth-report-2022).

[Insert Image Placeholder] A gritty shot of massive Bitcoin mining farms with rows of humming rigs—makes me sweat just looking at it, reminds me of my failed setup.

My Hands-On Mess with Proof of Work Energy Drain

Proof of work is raw, unfiltered capitalism— whoever throws the most hashpower wins. But the energy? Brutal. Bitcoin network alone guzzles more power than the Netherlands. I remember checking my rig’s temps, fans screaming, AC blasting to keep it cool. Felt powerful at first, then just stupid when the rewards dried up. Now in 2026, with energy prices still volatile post all those global messes, proof of work feels like driving a gas-guzzling truck when everyone’s going electric.

Proof of Stake Feels Easier, But Is It Too Easy?

Switched to staking ETH a couple years ago. Just run a node on my old laptop—quiet, no heat wave in my room, rewards trickle in. Proof of stake vs proof of work on energy? No contest. Ethereum’s basically green now (see ethereum.org’s breakdown: https://ethereum.org/en/energy-consumption/). But here’s where I get contradictory: staking’s chill, but centralization bugs me. Big pools like Lido control a ton of stake—over 30% sometimes. Rich get richer, whales dominate. What if regulators lean on Coinbase or Kraken staking? Poof, network wobbles.

[Insert Image Placeholder] Close-up of a simple home staking dashboard on a laptop screen, coffee stains on the desk for that personal, imperfect vibe.

Security Showdown in Proof of Stake Vs Proof of Work

Proof of work security? Buy hardware, burn energy—hard to fake. 51% attack costs billions in real-world gear. Proof of stake? Stake coins, but slashing punishes bad actors (lose your stake). Ethereum claims it’s more secure economically. But long-range attacks or centralization? Scary. I lost sleep once reading about potential PoS flaws—nothing happened, but yeah, I’m paranoid.

- Pros of PoW: Battle-tested (Bitcoin never hacked at consensus level), truly decentralized if mining spreads out.

- Cons of PoW: Energy hog, favors big farms in cheap-power spots (China used to dominate, now Texas?).

- Pros of PoS: Eco-friendly, low barrier (stake through pools if you can’t solo 32 ETH).

- Cons of PoS: “Nothing at stake” old critiques mostly fixed, but centralization real (Coinbase page on differences: https://www.coinbase.com/learn/crypto-basics/what-is-proof-of-work-or-proof-of-stake).

My Flawed Verdict on Proof of Stake Vs Proof of Work

Honestly? Proof of stake wins for me right now—my bill’s lower, setup’s simple, and the planet doesn’t hate me as much. But I miss proof of work’s gritty feel, and I’m hedging with some BTC. Contradictory? Yeah, that’s me. Crypto’s messy, like my desk right now—papers everywhere, cold coffee.

[Insert Image Placeholder] Side-by-side comparison chart, but from my skewed angle: one side chaotic mining chaos, other calm staking serenity.

Anyway, if you’re dipping in, start small. Stake a bit if you’re green-minded, mine if you’ve got cheap power and thick skin. Read up on CoinDesk’s solid comparisons. What’s your take? Drop a comment—I love hearing other flawed stories. Let’s chat crypto over virtual coffee.